Boost Your E-commerce Empire with Our Brand New Scaling Solutions

Are you ready to take your e-commerce business to new heights? Look no further! We offer a range of services designed to boost your online presence, maximize sales, and elevate your brand.

We Offered

e-Commerce Website Design

Create a visually appealing and user-friendly online store tailored to your brand. Ensure seamless navigation, responsive design, and easy integration with leading e-commerce platforms.

Digital Marketing Strategy

Develop a customized digital marketing plan to increase your online visibility. Implement SEO, social media marketing, and paid advertising to drive targeted traffic to your website.

Visual Content Creation

We Offer content creation services, including product descriptions, Videos, Shorts, Animation and multimedia content to engage customers and increase sales.

Conversion Rate Optimization (CRO)

Optimize your website for higher conversion rates through strategic A/B testing and user experience enhancements. Improve product listings, checkout processes, and call-to-action elements.

Social Media Management

Build and maintain a strong presence on social media platforms. Create engaging content, run targeted campaigns, and interact with your audience to foster brand loyalty.

Marketplace Expansion

Help businesses expand their reach by listing products on popular online marketplaces like Amazon, eBay, and Etsy. Provide guidance on optimizing product listings for each platform.

Remarketing Campaigns

Set up and manage retargeting campaigns to bring back visitors who didn't make a purchase and remarketing campaigns to upsell to existing customers.

Reviews Management

Develop strategies to gather and showcase customer reviews, testimonials, and social proof to build trust and credibility.

Influencer Marketing Campaign

Develop and execute influencer marketing strategies to leverage social media influencers and increase brand awareness and product visibility.

Mobile Optimization

Ensure your e-commerce site is fully optimized for mobile users, providing a seamless shopping experience on all devices.

Email Marketing Automation

Develop and execute email marketing campaigns to nurture leads, recover abandoned carts, and drive repeat business.

Performance Monitoring and Reporting

Regularly monitor key performance indicators (KPIs) and provide detailed reports on the effectiveness of different strategies and campaigns.

Our Services

Shopify Store Design

Transform your brand with a captivating Shopify store. We specialize in custom designs that enhance your online presence, ensuring a seamless and visually appealing shopping experience for your customers.

Facebook Ads Campaign

Let us drive targeted traffic and boost sales through expertly managed Facebook Ads campaigns. Our data-driven strategies maximize ROI, reaching your ideal audience with precision.

Visual Solution

Bring your products to life with compelling visuals. Our team creates engaging product videos and short clips, perfect for social media platforms, to showcase your offerings and captivate your audience.

Social Media Management

Boost your online presence with our comprehensive social media management. We create and curate content, engage with your audience, and implement strategies to grow your brand on platforms like Instagram, Twitter, and more.

Server Side Tracking

Optimize your analytics and data accuracy with server-side tracking. Our experts ensure precise tracking of user interactions, providing valuable insights to enhance your decision-making and marketing strategies.

Google Ads Campaign

Propel your business with targeted and results-driven Google Ads campaigns. From keyword research to ad creation and optimization, we tailor campaigns to maximize your visibility and drive high-quality traffic to your website.

Influencer Campaign

Harness the power of influencers to amplify your brand. Our influencer campaign management identifies and partners with the right influencers for your niche, creating authentic and impactful collaborations to expand your reach and build trust.

Dropshipping Partner

We specialize in creating seamless, profitable dropshipping setups, allowing you to launch and scale your online store without the hassles of inventory management. Let’s turn your entrepreneurial dreams into a thriving dropshipping empire.

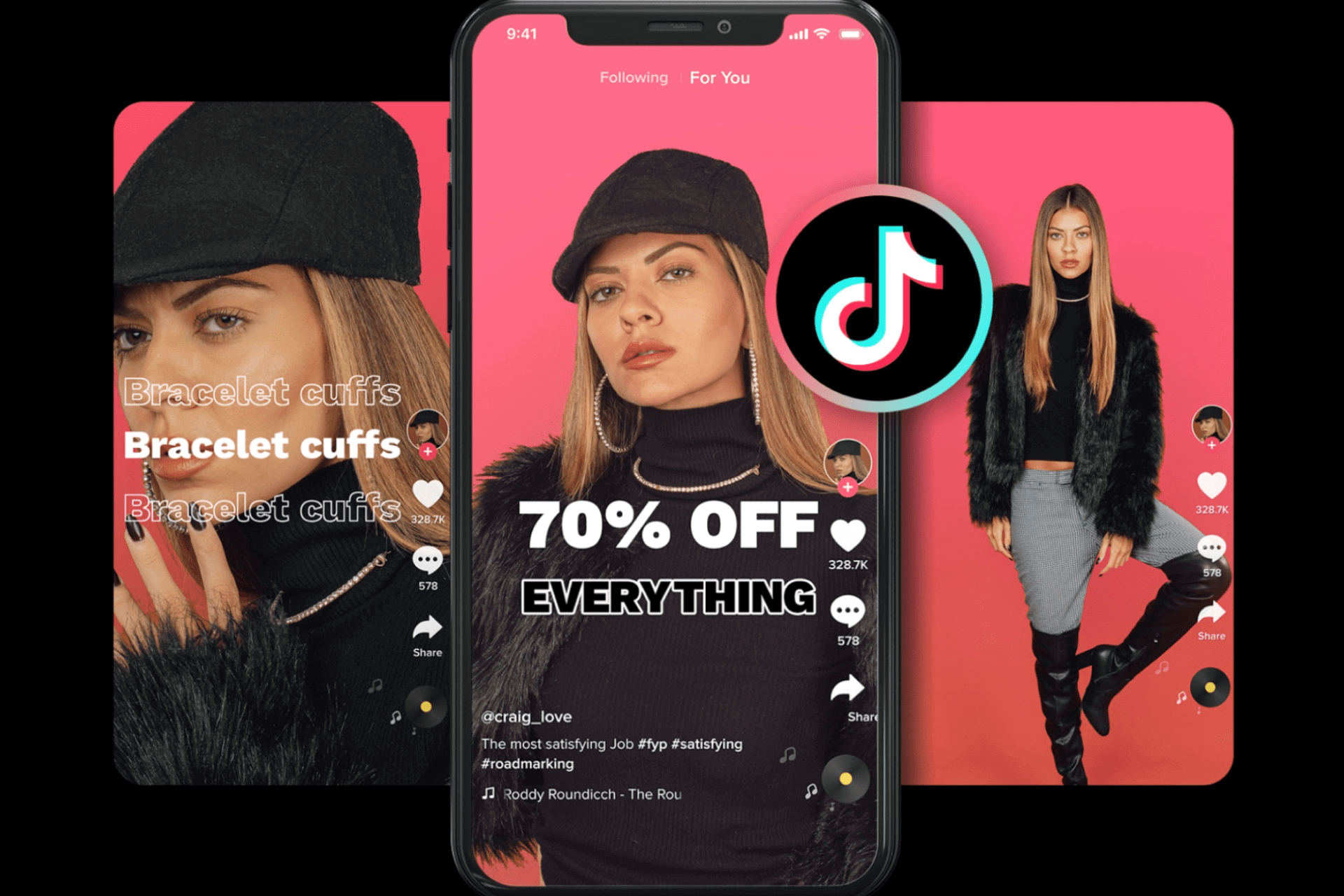

TikTok Ad Mastermind

Step into the world of viral marketing with our TikTok Ads services. We specialize in crafting innovative and engaging TikTok ad campaigns that capture attention, drive brand awareness, and spark user engagement. Let's leverage the power of TikTok to propel your brand to new heights of success!

Our Blog

TikTok Advertising: A Game-Changer for Your E-commerce Venture

In today’s digital age, reaching potential customers requires innovative strategies. Enter TikTok: the platform known for its engaging short videos.

Dropshipping Blueprint: Building a Foundation for Long-Term Success

In the fast-paced world of e-commerce, dropshipping has emerged as a popular business model for entrepreneurs looking to start an

Influencer Partnerships: A Blueprint for Success in E-commerce Marketing

Influencer partnerships have emerged as a powerful tool for brands to amplify their reach, build credibility, and drive conversions. By

Contact Us

Esolution INT

-

Dhaka Office

B-58 (Opposite of unity hospital South Banasree, Eastern Housing Project, Dhaka 1219

-

UK Office

Suite A 82 , Bury St., James Carter Road, Mildenhall, Bury St. Edmunds, England, England, IP28 7DE

-

Support Email